Car insurance premiums have been showing an upward trend for quite some time but the Confused.com car insurance price index has revealed that, on average, the cost of fully comprehensive car insurance has dropped slightly during the first quarter of 2018 when compared with a year ago. The average premium paid by motorists for such cover was £768 per annum with this being a small reduction of £13 per annum when compared to the first quarter of last year. This equates to a drop of around 2%.

Car insurance premiums have been showing an upward trend for quite some time but the Confused.com car insurance price index has revealed that, on average, the cost of fully comprehensive car insurance has dropped slightly during the first quarter of 2018 when compared with a year ago. The average premium paid by motorists for such cover was £768 per annum with this being a small reduction of £13 per annum when compared to the first quarter of last year. This equates to a drop of around 2%.

When you look at the cost of cover based upon someone’s age, the vast majority of age brackets have seen a fall in the amount charged by car insurance providers. On average, it is still the younger motorist who has to pay the most for their car insurance. For instance, an 18 year old is paying most with premiums costing on average of £2,114 per annum. A 17 year old is paying an average of £2,003 per annum but this is actually £118 per annum less than they were paying a year ago, whilst a 21 year old is being charged an average of £1,621 per annum to insure their vehicle with this being a rise of £38 per annum. A 34 year old has to pay an average of £655 per annum.

It is perhaps interesting that someone of 68 years of age has seen his or her car insurance premiums rise by an average of £40 in the space of 12 months to an average of £543 per annum.

On a regional basis, motorists in Inner London have seen the cost of insuring their cars drop by an average of £81 per annum in comparison to a year ago. That is a fall of 6%. However, they can expect to pay, on average, more than £1,000 per annum for fully comprehensive cover. However, a motorist living in the Scottish Borders has had to face an average increase of £32 per annum to an average of £579 per annum and drivers in North and Central Wales have seen their car insurance premiums go up by an average of £12 per annum in the space of a year to an average of £629 per annum.

Let us hope that the average cost of insuring a car continues to drop in the coming months. However, it is important that motorists try to obtain the right level of cover from an insurer that provides an excellent service including when it comes to processing claims and for a competitive premium. In this respect, you will be pleased to read that, here at AIB Insurance, we have an extensive panel of insurers that can hopefully meet your exacting requirements. So, why not give us a call on 02380 268 351 and speak with a knowledgeable, friendly member of our team who will do all that he or she can to obtain a competitive quotation for your perusal without any obligation.

According to the Confused.com Car Insurance Price Index that is produced in association with Willis Towers Watson, motorists will be disappointed to read that, in the first quarter of 2017, fully comprehensive car insurance premiums rose. This has been a trend for quite some time and it remains to be seen when it will end.

According to the Confused.com Car Insurance Price Index that is produced in association with Willis Towers Watson, motorists will be disappointed to read that, in the first quarter of 2017, fully comprehensive car insurance premiums rose. This has been a trend for quite some time and it remains to be seen when it will end. although in the first quarter of 2017 the average premium in that region actually dropped by £1 per annum.

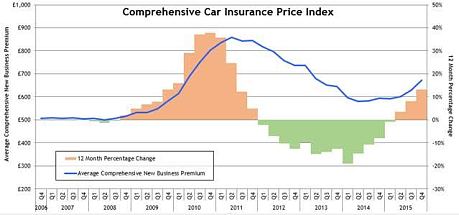

although in the first quarter of 2017 the average premium in that region actually dropped by £1 per annum. One of the price comparison websites called Confused.com has been producing its car insurance price index for 10 years on a quarterly basis. According to that index, the average cost of fully comprehensive car insurance has increased by £95 per annum (14%) to £767 per annum in the 12 months to the end of 2016. In fact, just in the 4th quarter of 2016, such premiums rose by an average of 4% that, in monetary terms, is an extra £30 per annum. The annual increase was due to a number of factors including things like the amount paid out for whiplash claims and Insurance Premium Tax (IPT) rising.

One of the price comparison websites called Confused.com has been producing its car insurance price index for 10 years on a quarterly basis. According to that index, the average cost of fully comprehensive car insurance has increased by £95 per annum (14%) to £767 per annum in the 12 months to the end of 2016. In fact, just in the 4th quarter of 2016, such premiums rose by an average of 4% that, in monetary terms, is an extra £30 per annum. The annual increase was due to a number of factors including things like the amount paid out for whiplash claims and Insurance Premium Tax (IPT) rising.

Whilst motorists have benefitted from a significant drop in fuel prices in recent months there has been a progressive increase in car insurance premiums in 2015. This is borne out by the Confused.com Car Insurance Price Index that is powered by Willis Towers Watson.

Whilst motorists have benefitted from a significant drop in fuel prices in recent months there has been a progressive increase in car insurance premiums in 2015. This is borne out by the Confused.com Car Insurance Price Index that is powered by Willis Towers Watson.

You must be logged in to post a comment.