Chris Smith built the first ever Westfield Sport Car in 1982 at his home named Westfield House. In 1983, he founded Westfield Sports Cars. Forty years later our club members are realizing just what a phenonium he started at the time. Club members, employees past and present and friends and family were saddened to hear of his passing away in November 2021. The following words and photos are from a Westfield Sports Car Club magazine article penned by member Nick Clarke who attended the funeral service.

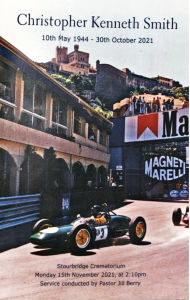

Chris Smith

(founder of Westfield Sports Cars)

10th May 1944 – 30th October 2021

I was deeply saddened after learning of the passing of Chris Smith, the founder of Westfield Sportscars.

When the family got in touch with the club asking if a few cars would be able to attend the funeral and wake, I myself felt compelled to make the effort.

With cars travelling from different parts of the country, most of us met at McDonalds in Stourbridge for some lunch beforehand, knowing we were only a few mins away from our first stop. We then set off for the funeral directors where parking was a bit of a challenge. We decided to park on the double yellows on the opposite side of the road a bit further down, and got ready to go once the funeral cars arrived. We were to then follow the cars to the crematorium which was only a couple of miles down the road, which I personally felt quite emotional. Thankfully we all made it without any of the cars boiling over, with my fan running almost constantly for 15 mins!

When we arrived at the crematorium, it was very clear that the family were very pleased to see 8 cars had managed to attend and pay tribute to Chris. Having been told beforehand that we’d be watching the service outside on a TV, we were surprised to be told to come inside.

It was a lovely service, and interesting to hear about Chris’s life and tales such as him taking pole position in Monte Carlo!

After the service, we felt a little out of place and decided not to hang around for too long, so we made our way over to the Dunsley Hall, the venue for the wake. When we arrived, we swiftly parked up outside the hall, making sure we were all ready for when the family arrived. It was then picture time, where we must have got 8 sets of photos of all the different angles of the cars outside the hall!

After a few minutes, the family arrived and the smiles on their faces as they saw the cars made it all worth it. We were all personally thanked by Richard and Holly for coming, and were once again surprised to hear that we were to come in for some refreshments, and not feel we have to leave early!

What a lovely old place this was, wood everywhere and fantastic views out the back.

After a nice chat with the others, 2 cups of tea and a slice of cake, we all decided to make a move. It was nice to meet the family, albeit in such sad circumstances, and I feel very privileged to have attended.

What a lovely family they are. Thanks Chris, for allowing us all to enjoy the cars you created all those years ago, and the opportunity to meet some lifelong friends along the way.

Rest in peace.

Thanks to our friend Nick Clarke, a member of the Westfield Sports Car Club for his tribute.

You must be logged in to post a comment.